how much tax is taken out of my paycheck indiana

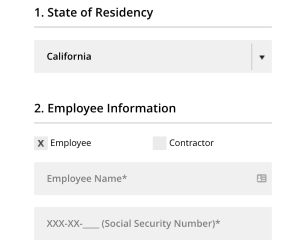

Indiana paycheck calculator Payroll Tax Salary Paycheck Calculator Indiana Paycheck Calculator Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or. Yes residents of Indiana are subject to personal income tax.

How To Form An Indiana Corporation In 2022

Simply enter their federal and state W-4 information as.

. All you need to do is enter the necessary information from the employees W-4 form pay rate deductions. In 2017 this rate fell to 323 and remains there through the 2021 tax year. The Indiana Paycheck Calculator will help you determine your paycheck.

FICA taxes are commonly called the payroll tax. Indiana has a flat statewide income tax. How much are payroll taxes in Indiana.

Roughly 78 of gross pay is left after Federal State Medicade and Social Security taxes are taken out. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. How Your Indiana Paycheck Works.

How much tax is taken out of 15 an hour. Our calculator has recently been updated to include both the latest Federal Tax. Both employee and employer shares in paying these.

The Indiana income tax is a flat rate for all residents. That means that your net pay will be 43041 per year or 3587 per month. However they dont include all taxes related to payroll.

How much do you make after taxes in Indiana. The amount of federal taxes taken out depends on the information you provided on your W-4 form. Put Your Check in a Bank.

Remember that whenever you. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Indiana. FICA taxes consist of Social Security and Medicare taxes.

The Indiana paycheck calculator will calculate the amount of taxes taken out of your paycheck. Best solution Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or. However many counties charge an additional income tax.

Yes Indiana does have personal income tax. For example a worker with an annual gross income of 40000 - or 3333. Newest Checking Account Bonuses and Promotions.

But on top of state income taxes each county charges its own. Your average tax rate is. To see how Indiana state income tax impacts your paycheck use the Indiana salary paycheck.

You are able to use our Indiana State Tax Calculator to calculate your total tax costs in the tax year 202223. How Much Tax Is Taken Out Of My Paycheck Indiana. Amount taken out of an average biweekly paycheck.

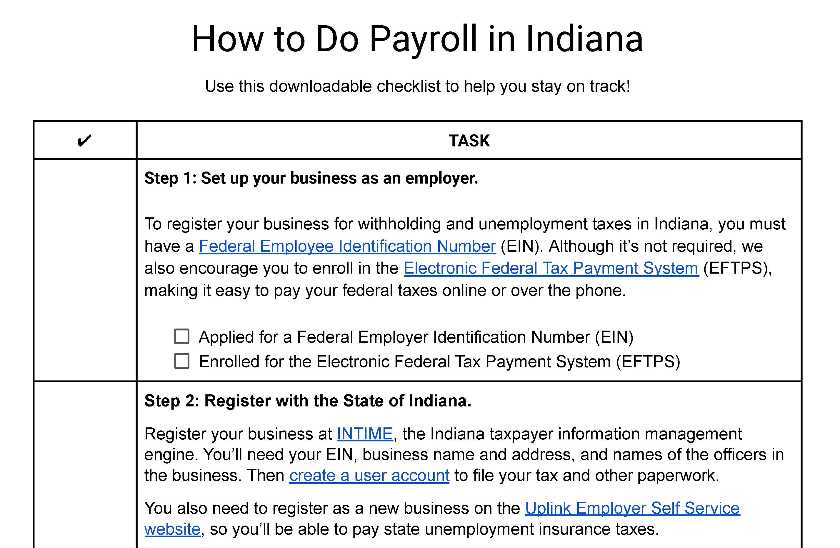

For example in the tax year 2020. The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. As an employer in Indiana you will have to pay the state unemployment insurance SUI which ranges from 05 to 74 on a wage base of 9500 per employee.

Indianans pay a flat income tax rate of 323 plus local income tax based on the county which ranges from 035 to 338. If you make 55000 a year living in the region of New York USA you will be taxed 11959. How much taxes do they take out of 1000.

Indiana State Payroll Taxes Its a flat tax rate of 323 that every employee pays.

How To Do Payroll In Indiana What Every Employer Needs To Know

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Indiana Tax Relief Services Tax Response Center

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Visualizing Taxes Deducted From Your Paycheck In Every State

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Indiana Paycheck Calculator Smartasset

Indiana Paystub Generator Thepaystubs

Indiana Hourly Paycheck Calculator Gusto

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Do I Have To Pay Tax To Both States If I Live In Indiana Work In Illinois Sapling

Covid 19 Resources Indiana State Bar Association

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Modeler All Iu Campuses One Iu

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Do Payroll In Indiana What Every Employer Needs To Know

Tax Withholding For Pensions And Social Security Sensible Money